Because we are continually adding New training programs in the academy, the price is subject to increase at any time!

Tax Sale Academy Platinum Package

>> Click Above For Video <<

Access to ALL of Our of Tax Sale Trainings!

Enjoy Our Entirely Online Based Training Platform

How to Profit from the (government mandated) Tax Foreclosure Process!

"That first auction I attended was the moment I discovered tax sale investing and the day my life was forever changed."

Tax Sale Investing. Buying and selling tax defaulted real estate is a business that most of the public doesn't even know exists. But . . . it has made countless millionaires.

For years, it was a good 'ole boys system in every town. Then technology came along. This opened it up to regular people, like me and you. It allows us to invest from the comfort of our own homes without needing lots of money, a license or someone "on the inside."

Although the traditional real estate investing markets (like the stuff you see on TV) are overly crowded right now, Tax Sale Investing is a niche that is often overlooked. Most people just don't understand it.

I first started investing in real estate back in 2002. I've invested in many states and have held and interest in more than 1,000 properties. You could say my degree is from the "School of Hard Knocks" - you know the one where you continually lose money until you hopefully one day figure out the things NOT to do. Eventually, I figured out the secrets to success and my business exploded!

After a number of years in the business, I taught a friend how to invest and this ultimately started the premier tax sale investing educational program - The Tax Sale Academy.

I can't wait to see you inside The Academy to teach you everything I've learned over the years! Let my academy be your shortcut to success in this business!

For years, it was a good 'ole boys system in every town. Then technology came along. This opened it up to regular people, like me and you. It allows us to invest from the comfort of our own homes without needing lots of money, a license or someone "on the inside."

Although the traditional real estate investing markets (like the stuff you see on TV) are overly crowded right now, Tax Sale Investing is a niche that is often overlooked. Most people just don't understand it.

I first started investing in real estate back in 2002. I've invested in many states and have held and interest in more than 1,000 properties. You could say my degree is from the "School of Hard Knocks" - you know the one where you continually lose money until you hopefully one day figure out the things NOT to do. Eventually, I figured out the secrets to success and my business exploded!

After a number of years in the business, I taught a friend how to invest and this ultimately started the premier tax sale investing educational program - The Tax Sale Academy.

I can't wait to see you inside The Academy to teach you everything I've learned over the years! Let my academy be your shortcut to success in this business!

Actual Tax Sale Properties

Here's just some of what's inside The Tax Sale Academy:

- How to Buy Your First Tax Sale Property

- How to Fund Your Investments (it's easier than you think)

- Understanding The Tax Sale Process

- How to Analyze Tax Sale Lists Quickly (like the pros do)

- Performing Due Diligence Quickly & Easily

- How to Value Real Estate

- Buying Properties Before, During & After Auctions

-

Buying Tax Sale Properties That Aren't Local to You

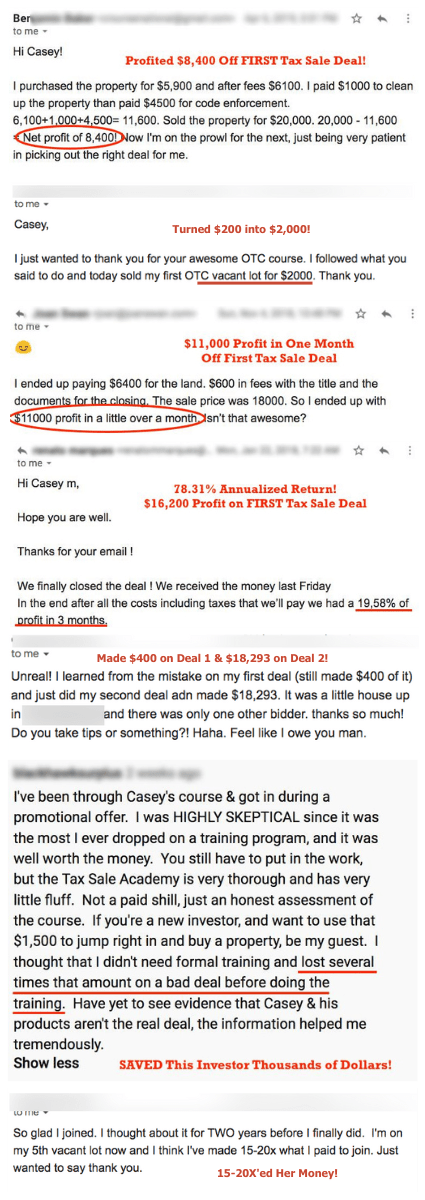

What People are Saying . . .

Here's what's included:

Here's a recap of the trainings inside . . .

TOTAL VALUE: $15,974+

Two Membership Options to Choose From!

Complete the Form Below to Get Started . . .

Prices subject to increase at any time. *During membership period.

Terms of Use & Refund Policy:

We make every effort to ensure that each of our products and services are represented accurately. However, no representations or warranties are provided or implied with respect to the accuracy or completeness of any information provided on this website or in any related materials.

We don’t guarantee that you will be able to replicate our results or the results of the examples provided and you understand that the income and earnings will differ by each individual. As with every business the results will vary greatly depending on your experience, desire, motivation and ability to learn. Without the proper motivation or ability to understand the concepts and strategies there is a possibility that a customer will not make any money or may even lose money. The strategies contained herein might not be suitable for your personal situation.

Prior to engaging in any investment activities we highly suggest you consult suitable outside counsel. The use of our products, services and any information we teach shall be done so based solely after your own due diligence. By using our products or services you agree that we are not liable in any way, shape or manner for any successes or failures related to the purchase and/or use of our products or services. As with any investment you make, you alone assume the inherent risk that you may lose some, all or more than your initial investment.

Refund Policy: Due to the significant discount offered with our Six Month and Lifetime Tax Sale Academy Memberships & Startup Packages including the programs shown on this page, we do not offer any refunds. We have invested a significant amount of time and resources into creating this program. If you're not fully committed, please do not purchase and we recommend you consume our free trainings instead.

To read our Privacy Policy please click here.

Copyright © 2024. The Tax Sale Academy & Casey Denman. All Rights Reserved.